How to Create and Maintain a Financial Budget:

Introduction

Do you feel like your money disappears before the end of the month? Don’t worry—creating a financial budget can be simpler than it seems. A well-structured budget helps you control your expenses, organize your finances, and plan to achieve your dreams. In this article, we’ll show you how to create a financial budget in a simple and effective way, highlighting its benefits and sharing practical tips to keep you on track. Ready to get started? Let’s go!

Why Is Creating a Budget Transformative?

Did you know that creating a financial budget can be the first step to transforming your relationship with money? This simple tool offers several benefits that can profoundly impact your financial life:

Debt Reduction: A budget helps you identify areas where you can cut expenses and redirect resources toward debt repayment. For example, by saving $ 200 per month on unused subscriptions, you can accelerate debt repayment and reduce financial stress.

Better Understanding of Expenses: By tracking your expenses, you discover spending patterns and areas where you can save. This allows you to make more conscious decisions aligned with your financial goals.

Building an Emergency Fund: With a budget, you can allocate a portion of your income to an emergency fund. Imagine the peace of mind knowing you are prepared for unexpected expenses, such as car repairs or medical emergencies.

Ability to Invest in the Future: A well-planned budget enhances your ability to invest in long-term dreams, such as buying a house, funding your children’s education, or planning for retirement. Every bit of savings today is a step toward a more stable future.

These benefits show how a financial budget can transform your life. With small changes and a bit of discipline, you can create a solid path toward financial stability.

Simple Steps to Take Control of Your Money

Creating an effective financial budget doesn’t have to be complicated. Follow these simple steps and start organizing your finances today:

Record Your Total Income Write down all your sources of net income, such as salaries and freelance work. Use real values to have an accurate view of how much you actually earn. For example, if your net monthly income is $ 3,000, record exactly that amount as your baseline.

List All Expenses

Divide your expenses into categories:

Essentials: Fixed bills, transportation, food.

Variables: Leisure, shopping, and subscriptions.

Use bank statements and receipts to record amounts accurately. This helps identify where your money is going.

Analyze Your Financial Situation: Compare your income and expenses to determine whether you have a positive balance (surplus) or a negative balance (deficit). For example, if you spend $ 2,800 per month, that leaves a surplus of $ 200. If the balance is negative, identify areas where you can reduce expenses immediately.

Set Financial Goals

Define clear and achievable short- and long-term goals. Examples include:

Paying off a debt in six months.

Saving $ 5,000 for an emergency fund.

Saving for a trip or future investment.

Goals help keep you focused and make planning more motivating.

Adjust Your Spending Habits

Identify unnecessary expenses and find areas to cut back. Practical tips include:

Canceling unused subscriptions.

Setting a weekly limit for leisure expenses.

Choose Organizational Tools: Use tools that simplify the organization process. For beginners, spreadsheets like Google Sheets or Excel are great options. Additionally, apps like Mobills and Guiabolso can help keep your budget updated and make monthly reviews easier.

How to Keep Your Budget Updated and Functional

Maintaining a financial budget requires discipline, regular adjustments, and commitment. Here are some practical tips to help you stay on track:

Review Regularly: Set aside a moment at the end of each month to analyze your budget. Ask yourself: Am I spending more or less than I planned? Are my financial goals being met?

For example, by reviewing your expenses, you may notice that unused service subscriptions are costing you $ 150 per month. Canceling these subscriptions can free up resources for your savings or investments.

Adapt as Needed: Life changes, and your budget should adapt to those changes. A new source of income or an unexpected increase in expenses may require immediate adjustments.

Example: If your electricity bill rises due to air conditioner use in the summer, adjust your budget by reducing spending in other areas, such as leisure.

Involve the Family: If you live with others, such as a spouse or children, involve them in the financial planning process. When everyone understands the financial goals, it becomes easier to control expenses and work together.

Tip: Organize a monthly family meeting to review the budget and discuss priorities. For example, saving together for a trip can motivate everyone to cut back on small expenses.

Simple Budget Examples

To make it easier to understand how a financial budget works in practice, let’s look at two fictional scenarios:

Scenario 1: Basic Organization

Monthly Income: $ 3,000

Fixed Expenses: $ 1,800

Rent: $ 1,000

Utility bills: $ 400

Transportation: $ 400

Planned Savings: $ 600 (emergency fund or investments)

Variable Expenses: $ 600 (leisure and personal shopping)

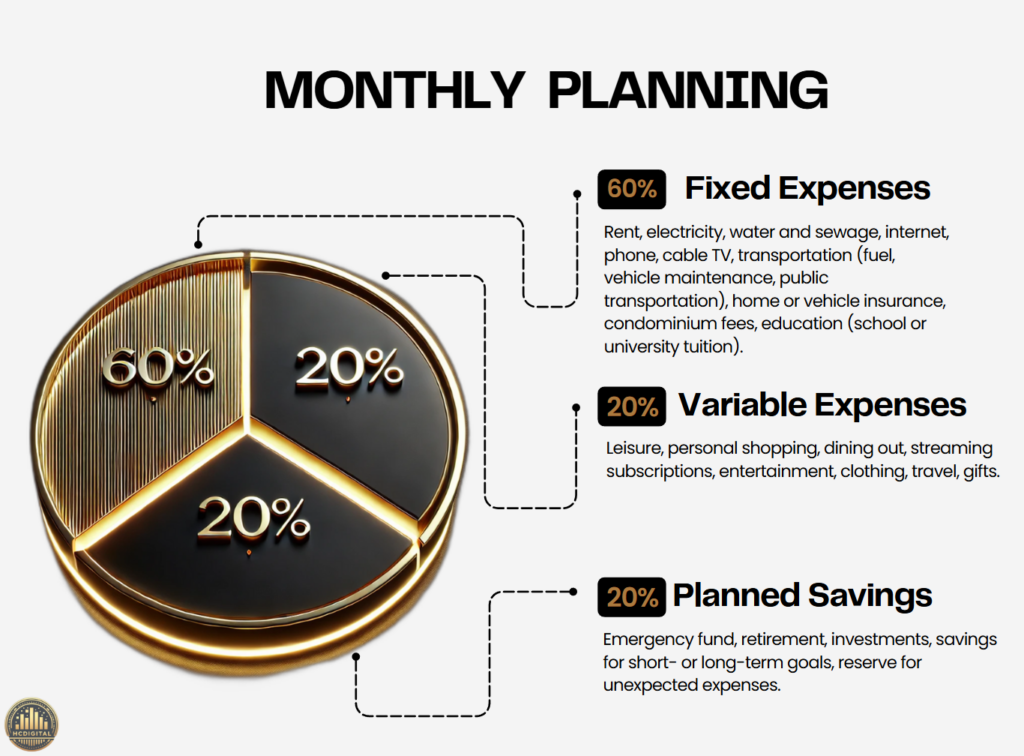

Below, you can explore how this expense organization would appear in a simple chart, available for download in the resources section of this article:

The chart above visually illustrates the suggested organization for your monthly expenses. Notice how the majority of the budget is allocated to fixed expenses, ensuring that your basic needs are met, while the 20% reserved for savings and 20% for variable expenses allow for a healthy balance between financial security and quality of life. Use this proportion as a starting point and adjust as necessary to fit your reality.

In this scenario, you can cover your basic needs while still setting aside 20% of your income for future savings.

Scenario 2: Adjustment to Get Out of Debt

Monthly Income: $ 3,000

Fixed Expenses: $ 1,800 (no changes)

Variable Expenses: $ 420 (reduced leisure and shopping)

Debt Payments: $ 390

Planned Savings: $ 390

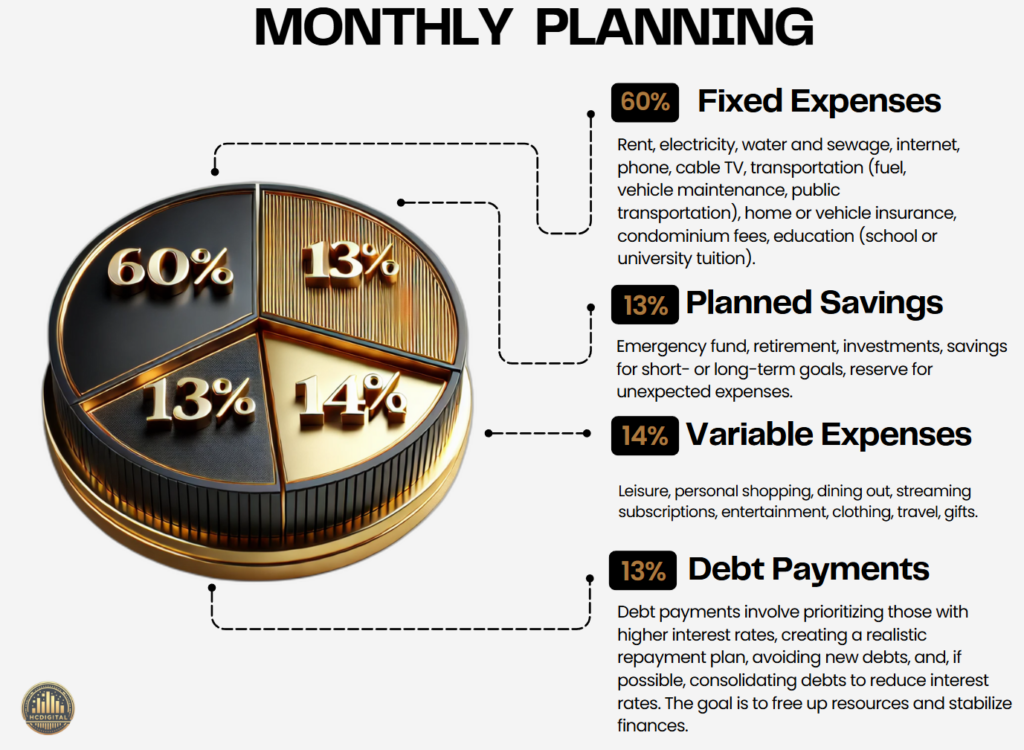

Below, you can visualize how this expense organization would look in a simple chart, highlighting the ideal proportion for each category:

This scenario focuses on financial adjustments to get out of debt. Fixed expenses remain a priority, representing 60% of the monthly income. To ensure balance, variable expenses have been reduced to 14%, freeing up 13% for debt payments and another 13% for planned savings. This approach ensures that you can pay off debts while maintaining a growing financial safety net.

13% for planned savings. This approach ensures that you can pay off debts while maintaining a growing financial safety net.

By reducing variable expenses, you free up resources to pay off debts and start saving. This simple adjustment can be the first step toward organizing your finances and getting out of debt.

Flexibility in Budget Models There

is no universal formula for creating a financial budget, as circumstances and priorities vary widely between individuals and families. Instead of following rigid rules, it is ideal to use models as initial guidelines and adapt them according to your reality and financial goals.

Why Fixed Models Don’t Work for Everyone

Differences in Cost of Living: Someone living in a high-cost city may need to allocate up to 70% of their income to fixed expenses, while someone in a more affordable area might spend less than 50%. For example, a professional living in New York may prioritize transportation and rent, whereas someone in a smaller city has more flexibility to save or invest.

Debt and Savings Situation: Those without debt can allocate a larger portion of their income to investments or leisure. On the other hand, someone with significant debt may need to dedicate more than 20% of their income to paying it off quickly. Imagine a person with a $ 10,000 loan: redirecting 15% or more of their budget for accelerated repayment can help avoid prolonged interest.

Different Goals: A university student may prioritize saving for education, while a family might focus on building an emergency fund or purchasing a home.

How to Adapt Budget Models

Evaluate Your Current Situation: List all fixed and variable expenses. Identify which are non-negotiable and which can be adjusted. For example, subscriptions and leisure expenses are the first candidates for cuts if debt levels are high.

Try Different Proportions: Test models like 60-13-14-13 for 2-3 months. Assess the impact on your financial situation and adjust as necessary. If the 14% allocated to debts seems insufficient, increase it to 16% and temporarily reduce another category.

Make Temporary Adjustments: If the goal is to pay off a debt, you can redirect part of the budget toward intensive payments for a few months, returning to balance afterward.

Example: Reduce variable expenses from 13% to 10% and increase debt payments from 14% to 17%.

Practical Example of Adjustment

Imagine you are using the initial 60-13-14-13 model. After 3 months, you notice that:

You are comfortable with the 60% allocated to fixed expenses.

You need more flexibility for leisure, as 13% is not enough.

In this case, you can adjust to 60-12-14-14, increasing leisure spending while temporarily reducing planned savings.

Reevaluate Your Planning

Financial budgets should be dynamic tools, adapted to each individual’s needs and life changes. There is no perfect model, but rather an adaptive approach that balances current priorities with future goals. Evaluate, test, and adjust continuously to create a sustainable plan.

Turn Your Plan into Action!

Creating and maintaining a financial budget is not just a practical task but an investment in your future. Every step you take toward better control of your finances is a step toward financial freedom. Small changes today can lead to significant results tomorrow.

What strategies do you already use to organize your finances? Share this article with someone who might benefit and start transforming your relationship with money today. Together, we can build a stronger and more secure future!